Highly personal or unconventional upgrades, over-improving beyond neighborhood standards, and poor-quality workmanship or materials often don't add significant value.

No, home improvement typically refers to renovating or making changes to an existing home, while construction often implies building something from the ground up.

For personal residences, a new roof is not tax-deductible in the year it's installed. However, it can add to your home's cost basis. If the property is for business or rental, you might be able to claim it through depreciation.

It depends on the historical value, the condition of the house, and personal preferences. Sometimes renovations can add significant value, both financially and sentimentally.

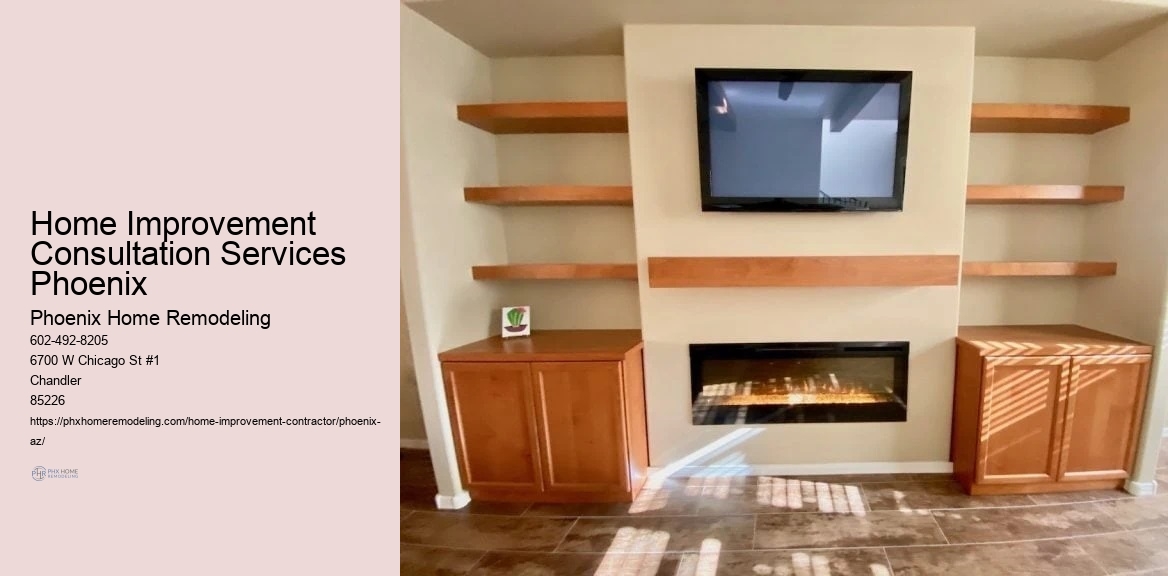

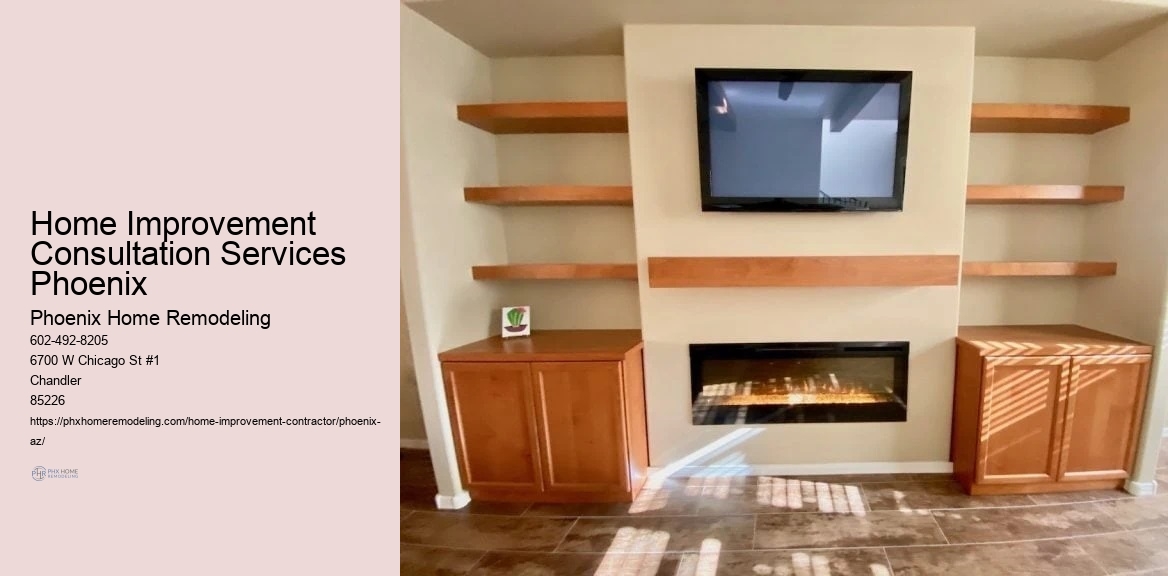

Home improvement includes projects that upgrade an existing home interior, exterior, or other improvements to the property.